A Biased View of Eb5 Investment Immigration

A Biased View of Eb5 Investment Immigration

Blog Article

Get This Report on Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration Can Be Fun For EveryoneThe 6-Second Trick For Eb5 Investment ImmigrationNot known Details About Eb5 Investment Immigration Eb5 Investment Immigration - TruthsHow Eb5 Investment Immigration can Save You Time, Stress, and Money.

While we make every effort to supply exact and updated web content, it should not be taken into consideration legal recommendations. Immigration legislations and guidelines undergo transform, and private circumstances can differ commonly. For individualized support and legal recommendations regarding your certain migration circumstance, we strongly suggest talking to a certified immigration lawyer who can supply you with tailored aid and make sure compliance with present laws and policies.

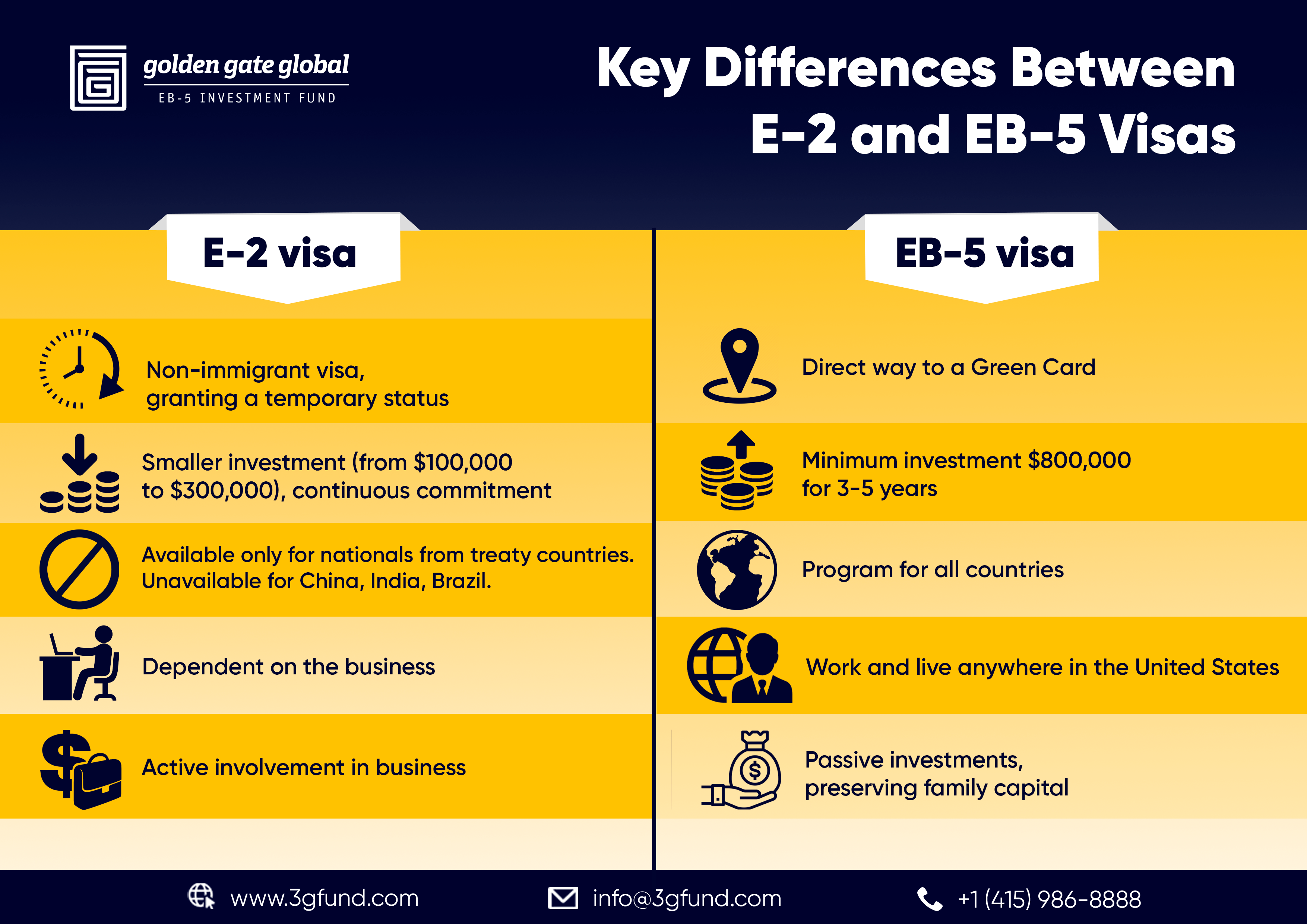

Citizenship, via investment. Presently, as of March 15, 2022, the quantity of investment is $800,000 (in Targeted Work Areas and Country Locations) and $1,050,000 elsewhere (non-TEA zones). Congress has approved these quantities for the following 5 years starting March 15, 2022.

To certify for the EB-5 Visa, Capitalists should develop 10 permanent U.S. work within two years from the day of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Demand makes certain that financial investments contribute directly to the U.S. job market. This applies whether the work are created directly by the company or indirectly under sponsorship of an assigned EB-5 Regional Center like EB5 United

Some Known Incorrect Statements About Eb5 Investment Immigration

These jobs are determined through models that use inputs such as advancement expenses (e.g., construction and devices expenses) or yearly revenues produced by continuous operations. On the other hand, under the standalone, or direct, EB-5 Program, only straight, permanent W-2 staff member settings within the industrial venture may be counted. An essential risk of counting solely on straight staff members is that personnel reductions because of market conditions can result in insufficient full time placements, potentially leading to USCIS rejection of the capitalist's petition if the job creation need is not met.

The economic model then predicts the variety of straight tasks the brand-new business is likely to produce based upon its awaited revenues. Indirect tasks determined through economic versions refers to work produced in sectors that provide the items or services to business straight included in the job. These jobs are produced as a result of the raised demand for items, products, or services that support business's operations.

The Only Guide for Eb5 Investment Immigration

An employment-based 5th preference category (EB-5) financial investment visa offers a technique of becoming a permanent U.S. homeowner for foreign nationals intending to spend funding in the United States. In order to get this eco-friendly card, a foreign financier needs to spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Location") and create or protect a minimum of 10 permanent work for United States employees (leaving out the financier and their immediate household).

This procedure has actually been a tremendous success. Today, 95% of all EB-5 funding is elevated and spent by Regional Centers. Because the 2008 monetary situation, accessibility to resources has been restricted and municipal budgets remain to face significant shortages. In several regions, EB-5 financial investments have actually filled the financing space, giving a new, crucial resource of capital for neighborhood economic development tasks that rejuvenate neighborhoods, develop and support tasks, facilities, and solutions.

9 Easy Facts About Eb5 Investment Immigration Shown

More than 25 nations, including Australia and the United Kingdom, usage similar programs to draw in international investments. The American program is much more rigorous than several others, requiring considerable risk for capitalists in terms of both their financial investment and migration status.

Families and people who seek to relocate to the United States on an irreversible basis can obtain the EB-5 Immigrant Investor Program. The USA Citizenship and Immigration Services (U.S.C.I.S.) laid out different needs to acquire long-term residency through the EB-5 visa program. The demands can be summed up as: The investor needs to fulfill capital expense amount requirements; it is normally needed to make either a $800,000 or $1,050,000 capital investment amount into a UNITED STATE

Talk with a Boston immigration lawyer regarding your demands. Below are the basic actions to getting an EB-5 investor copyright: The initial step is to discover a certifying financial investment possibility. This can be a brand-new company, a regional facility task, or an existing company that will certainly be broadened or restructured.

When the chance has actually been determined, the capitalist must make the financial investment and submit an I-526 application to the U.S. Citizenship and Immigration Provider (USCIS). This request must include evidence of the financial investment, such as financial institution declarations, acquisition agreements, and service strategies. The USCIS will evaluate the I-526 request and either approve it or demand extra proof.

Eb5 Investment Immigration Fundamentals Explained

The investor you can try this out needs to make an application for conditional residency by sending an I-485 petition. This application must be submitted within 6 months of the I-526 approval and need to consist of proof that the financial investment was made and that it has actually developed a minimum of 10 full-time tasks for united state workers. The USCIS will examine the I-485 petition and either authorize it or demand extra straight from the source evidence.

Report this page